Algoma Steel: Deeply Discounted Independent Steel producer

Ticker: ASTL, Listed both on the NASDAQ and TSX. All dollar amounts are demarcated as USD or CAD, current conversion rate is 1.35CAD to 1 USD or 0.74 USD to 1 CAD.

Business Overview:

Algoma Steel Group is a fully integrated steel producer of hot and cold rolled steel products including sheet and plate. With a current production capacity of 2.8 million tons per year. Algoma has a diverse set of capabilities such as annealing, galvanizing, heat-tempered, and oil products. Algoma’s steel products are used in a diverse set of industries such as automotive, construction, energy, defense, and manufacturing. They are based in Sault Ste Marie, Ontario, positioned between Lake Huron and Lake Superior, bordering the Upper Peninsula of Michigan

Timeline:

In 1901, Francis Clergue founded the Algoma Iron, Nickel, and Steel Company in Sault Ste. Marie. Construction of the steel plant finished the next year. During the First World War, Algoma made munitions for the war.

In 1935, Sir Humphrey Gilbert took over ownership after the previous owners were too focused on extracting dividends from the business and not reinvesting. During his years of ownership and by 1950, through reinvesting in the business, the company entered into prosperous times.

In 1988, Dofasco bought Algoma, but by 1991, due to steel worker strikes across Ontario, Dofasco was forced to divest Algoma.

By the early 2000s, a strong Canadian dollar, mini-mill competition, and Japanese dumping hurt Canadian steel producers. In 2001, the company entered into CCAA again, but for the next 3 years, led by Denis Turcotte, Algoma staged a huge resurgence with the company announcing a Substantial Issuer Bid and Special Dividends once out of CCAA by 2004.

In 2007, Indian Conglomerate Essar Global purchased Algoma Steel for $1.85B CAD and subsequently changed its name. Due to a bad steel environment, the company once again entered CCAA in 2015 and entered into a sale-leaseback transaction for its port to raise capital, though this would not be enough.

By 2017, the company had rebranded to Algoma as the senior lenders of their debt acquired 100% of equity. In November of 2018 as a group of U.S investors acquired Algoma for $600M USD. Some notable sophisticated credit & restructuring funds that stayed, notably, were Bain, Contrarian Capital, and Goldentree. They restructured, focused on consolidating debt, reducing and restructuring environmental and pension liabilities, recapturing the port, and investing in downstream operations ($150M - $200M). Because Algoma was in bankruptcy protection (CCAA) during some of the worst times for steel, the restructuring done was focused on making sure Algoma had the ability to persist through the worst times in the industry.

By 2021, the company went public through a SPAC merger (“Legato Merger), providing the company through PIPE and public investors over $300M in cash to partially fund the Electric Arc Furnace transition and pay off the remaining Senior Debt holders.

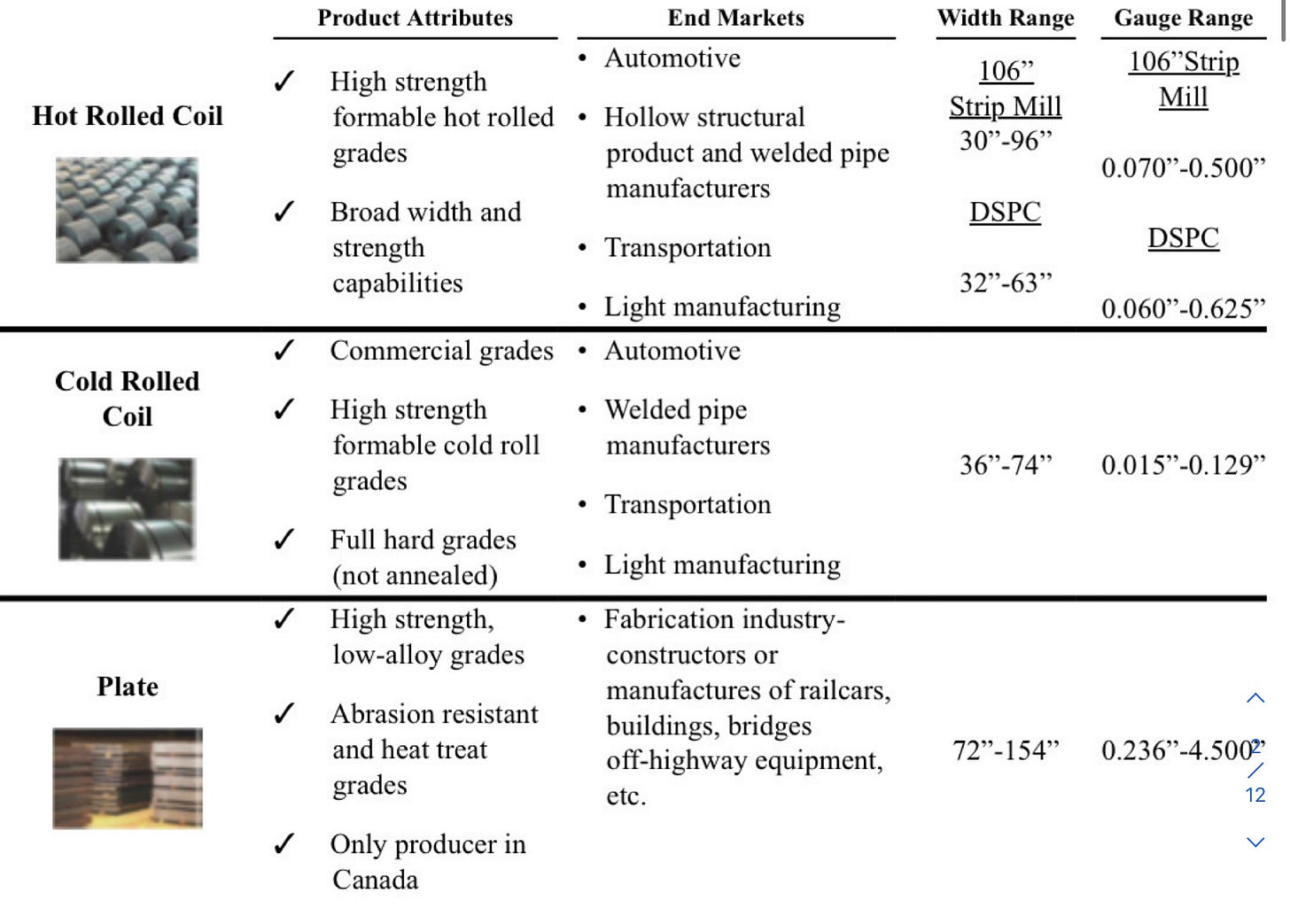

Product Mix:

Of the total steel shipments over the past few years, excluding the last few quarters, 85% of steel is sheet steel with roughly 9% - 10% of that being Cold-Rolled coil (CRC) coming from the 80 inch Cold Reduction Mill and the rest being Hot-Rolled Coil (HRC) coming primarily from the Direct Strip Production Complex (DSPC)

The other 15% that is not sheet steel is steel plate coming from the 166’’ plate mill with half of that being heat-treated along with other customizations such as abrasion-resistance. As a note, plate pricing historically has been $150 - $200 USD above Hot-rolled coil, though in the last year and a half, this premium has been over double with HRC at $1,133/nt and plate at $1,560/nt as of March 27, 2023 along with CRC being $95/nt above HRC at $1,228/nt.

Production Line:

As previously mentioned, the company produces the majority of its sheet steel through its 2,300kt capacity Direct Strip Product Complex (DSPC) which allows for the creation of finished steel products directly from its , giving a $30-$40/ton cost advantage alone (management). The Company has the ability to do annealing, trimming, cutting-to-length, recoiling, Oiling, and galvanizing style finishing along with the DSPC leading into the Cold Mill for CRC production

The company also operates a 2,000kt slab caster which feeds into a 460kt 106’’ strip to produce HRC and into the 350kt 166’ plate mill to produce steel plate, the only one in Canada.

This diversity of mills, along with having the only plate mill in Canada and Direct Strip Product Complex (DSPC) allows for Algoma to have a broader width and gauge range than competitors such as StelCo, who yes have similar finishing, but not the diversity of product, which gives Algoma a competitive advantage in minor cases.

Steel Pricing:

As said before, 85% of steel shipments are sheet steel with the other 15% being steel plate. Though the company does enter into steel futures to hedge the volatility of the market, it is small in comparison to total shipments, and has been declining as of recent.

What is more substantial is that 10% of pricing is fixed yearly, 50% - 55% of pricing is on a lag-pricing mechanism split between 1-month and 3-month lagging, and the last 35% - 40% is based on spot pricing with associated lead times averaging four to eight weeks in a normal steel environment, it already has a natural lag.

Iron Ore

First on the list of inputs: iron ore! The company has two iron-ore supply contracts with Cleveland-Cliffs and U.S Steel. The iron-ore is priced on a 6-month lag to indices. Because of Algoma’s position on the Great Lakes, they are the first stop of iron ore freights traveling from Minnesota, Wisconsin, and the Upper Peninsula to all the steel mills on the Great Lakes, giving them a nice cost advantage for iron ore freight. Total Iron Needs, on average, are 3.5 million tons annually.

Scrap Steel

Second on the list is scrap steel, which isn’t the main source needed for blast furnaces, but is able to be added in limited amounts, equaling 10% - 15% of steel production costs at this point in time. Algoma has a Joint Venture with Triple-M Metal for scrap steel at below-market pricing and various grades (prime/obsolete). It should be noted that half of scrap requirements are filled internally and the rest is from regional sources such as scrap centers like Detroit, Toronto, and Chicago which the company has great access to and will benefit it in its EAF transition.

Coke:

Next we have coke (coking coal) and coal. The company with its 3 internal coke ovens provides for the majority of coke needed. The rest of coke needs are met by a 5-year long take-or-pay contract with SunCoke that is renominated every fall and is below-index normally. This is below-index pricing is partially due to the long-term nature of contracts, but also due to the fact that prices are influenced by higher export prices.

Metallurgical Coal:

Coal, which is also used to make coke and for thermal energy, has needs of roughly half of steel shipments. The coal is sourced from Central Appalachia and contracts are fixed yearly with pricing during Q4 & Q1 of the Calendary Years.

Other Inputs:

The last minor inputs are natural gas which is sometimes hedged with futures, though most electricity needs are met with the low-cost cogeneration facility. Nevertheless, usage average 6MMBTU per ton. Also Oxygen is under a long-term supply agreement with Praxair Canada.

Here is the model I developed and backtested with aid from other models for non-mentioned inputs as in general, there aren’t huge differences in the average BOF/BF steel making cost structure:

Industry Overview (basic):

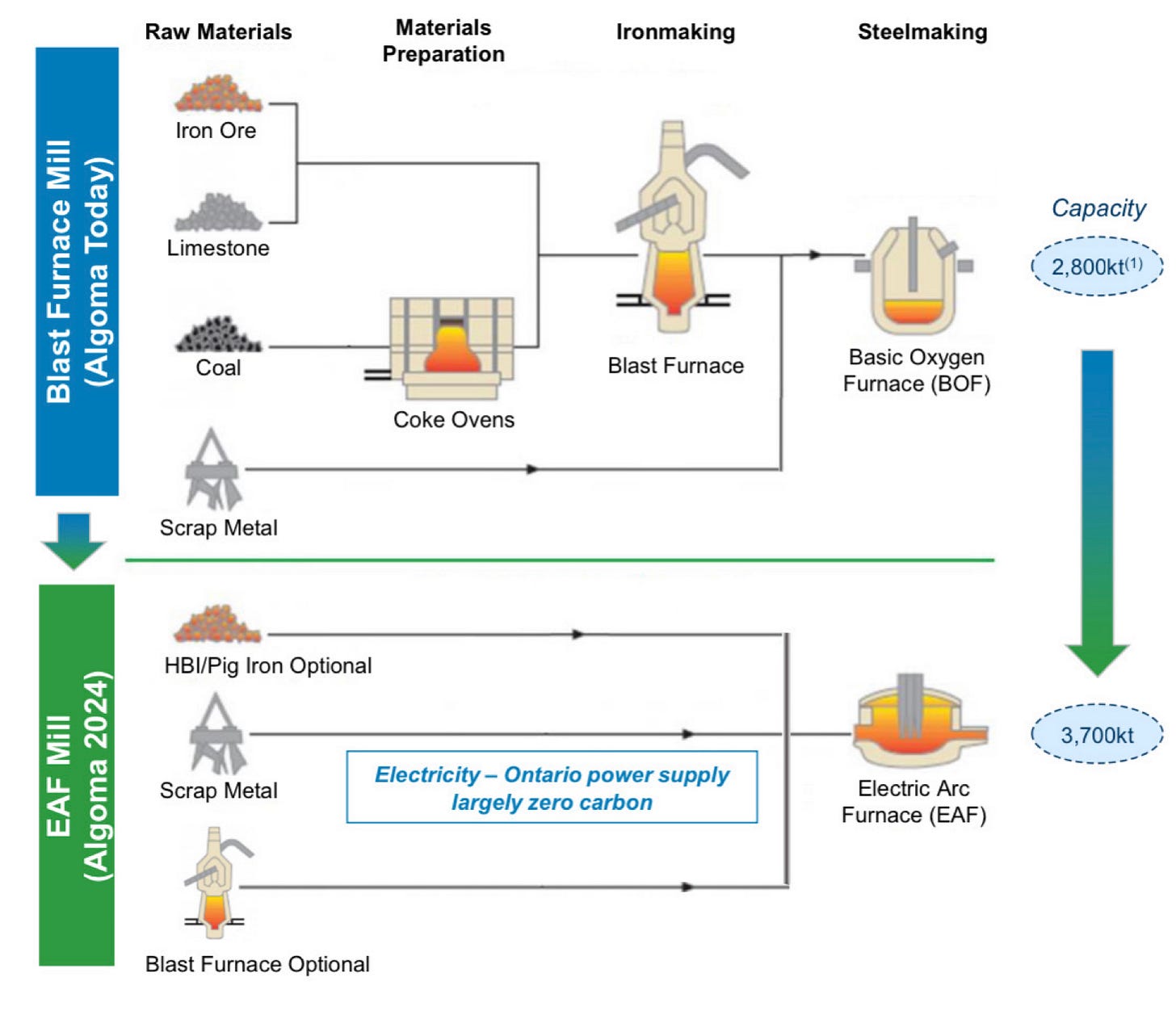

The Steel Industry in the broad sense is composed of two types of operators: large integrated mills and mini-mills. The large integrated mills run with Blast Furnaces (BFs) for iron production and Basic Oxygen Furnaces powered by coal for steel production and may also have on-site Direct-Reduced Iron making operations for internal use along with selling. They often have at least 2 million ton capacity in order to be economical at their size.

The other types are mini-mills which have smaller capacities and have EAFs that utilize steel scrap feed and in some cases DRI & Pig Iron, allowing for operations to be smaller and more flexible.

To recap, BFs take in Iron Ore and Limestone (Flux Material) from a Sintering Plant and Coke made from metallurgical coal in coke ovens to create High Purity Iron which is then cast in a BOFs to be turned into raw liquid steel which is then refined more in Ladle Metallurgy Furnaces (LMFs) which are used to pour into subsequent mills to be shaped into the final steel products, in a simple sense. In a mini-mill though, steel scrap is fed directly into an EAF where it is melted down to raw steel then poured into an LMF to be cast on a mill into the final product.

Because of this energy involved, an adequate water source is needed, along with access to transport for input materials and steel shipments, as Integrated Mills tend to serve larger areas whereas mini-mills tend to serve small areas because of their capacity.

Geographic advantage:

Algoma, being strategically located on the Great Lakes, Algoma owns an adjacent port facility in Sault Ste Marie which is the fourth largest port on the Great Lakes, handling over 5 million tons of shipments, facilitating Algoma’s access to low cost transportation and a secure distribution network.

This low cost network is seen through Algoma’s proximity to iron ore mines such as Cleveland-Cliffs (CLF) at Tilden in Michigan 150 miles away connected by rail and 6 other mines owned by CLF and U.S Steel (USS) with nearby ports in Minnesota. And in the case when the lake freezes over, railroad transportation is available from not only Tilden nearby, but all of the other mines too. This advantage is also seen through the fact that Algoma is the closest integrated steel mill on the map:

To also mention, Algoma is in close proximity to major industrial cities like Toronto, Detroit, and Chicago making it so that once they transition to EAF, they will have access to scrap at good prices.

Besides its location giving Algoma greater access to raw materials and some power of suppliers, it also gives it a clear competitive advantage over its peers through freight costs. Any customer located 250 miles away has a freight cost of $30-$35/ton on average and any located between 250-600 miles has a freight cost of $35-$60/ton. Of its top 10 customers that compose around 50% of revenue, 9 of them are located within 600 miles and the average tenure among these ten is over 20 years on average, showing how even though this is a commodity business, there is still some cost advantages that lower the threat of substitutes.

What has to be considered is that though yes its customers are technically in better proximity to other steel plants than to Algoma, not all steel plants produce flat-sheet HRC and CRC and it is even rarer for the average plant to produce steel plate. This gives Algoma a larger market than seen on a normal map of the 108 steel plants in North America.

In addition to these advantages, the company is trying, through a direct sales team, to get large Canadian Customers (50%-60% of sales from current of 35%-40%) in order to decrease freight costs along with lower income taxes (38% rate but no federal abatement of 10% on income earned outside of Canada).

Plate Mill Modernization:

The Company, over the last year and a half, has undertaken a modernization project on its plate mill which has two phases for a total cost of $135M CAD which is being partially funded by $50M CAD in government loans fortunately.

The first phase, which is already finished and been implemented, focused on enhancing the quality of the plate product line. This higher product quality is meant with respect to surface and flatness, increased strength, and availability of new grades (structural/carbon). This was done through the upgrade/installation of a slab de-scaler to improve surface quality, an automated surface inspection system, an in-line hot leveler to improve flatness, and autorotation of the mill to expand the company’s offering.

The second phase, which is to be implemented in a 40-day close period during H2 2023, is focused on increasing overall plate shipment capacity through debottlenecking and automation. As of current, capacity is 350kt - 400kt, this modernization phase should bring it up to at least 700kt, though plate finishing will not be expanded much. This phase will be done through onboard descaling systems for the roll stands, mill alignment, new cooling beds and shear line, dividing shear, plate Pilger, and automated marking machine.

With plate making 15% of shipments currently, with this second upgrade, plate will make up 20% - 25% of shipments and the automation will increase efficiency and margins. As said before, the pricing gap between HRC and Plate as of current is $430/nt USD, and there is a consensus that this pricing will stay as there hasn’t been much capacity addition besides Nucor’s 1.2M ton capacity plant in Fredericksburg, Kentucky starting up last year.

The return on this is hard to say since excluding the EAF transition, this is diverting away steel from the DSPC and thus return is earned through incremental margins of plate over HRC. Nevertheless, it is clear from the likely around $135M CAD in revenue of plate in Q1, plate’s higher margin nature over HRC and CRC, along with additional capacity makes this a great move.

Unfortunately, due to commissioning and ramp-up problems because the modernization’s software intensive nature, the mill was operating at low capacity and this caused an estimated $65M CAD EBITDA loss during Q3 & Q4 2022. Though commissioning and ramp up for 2nd phase will take 6-12 months, the lessons learned from the delays of the first phase will hopefully help out in the second phase, though it is risk that must be noticed.

Electric Arc Furnace Transition:

As I have mentioned throughout this report, the company is undergoing a transition from BOF to EAF with the eventual elimination of BF also. The transition should improve product mix, reduce fixed costs, provided carbon tax savings, increase capacity, and decrease footprint. The construction should be done my mid 2024 and commissioning and ramping up should take 6-12 months.

To get into specifics, the total budget of the project is $700M CAD including $85M CAD of contingency, of which only $33M has been spent. Total spending on the project to EOY2022 is $220M CAD, with $80M to be spent in Q1 2023, and the rest to be spent afterwards. Over 70% of the price tag has committed fixed price contracts and so the project is unlikely to go over budget.

The project is to be financed by cash and by a $200M CAD loan from the Government’s Strategic Innovation Fund (SIF). If the 70% reduction in carbon emissions is done (which it will be by a function of physics), this loan will turn into a grant.

Once the Commission ramp is done from mid 2024 to 2025, Oxygen steel making (BOF) will be completely off, though until 2028, one of the blast furnaces will need to operate at reduced capacity, fulfilling only 30% of hot metal charge.

The reduced BF operations will be needed because on-site power generation and grid power won’t be able to operate both EAFs at the same time, though by 2028-2030, the company will have no internal power generation and be fully on the Ontario Grid.

Overall, we can see that even in this commoditized industry, Algoma has a pretty strong moat and competitive position. This can be summarized through Four areas:

1. Product Diversity & Plate - A significant amount of product diversity through its many finishing options along with it being the only steel plate mill in Canada. This advantage/component is being expanded through the plate mill modernization which will increase quality and quantity of plate produced.

2. Pricing advantage - not only does the company have a majority of steel sold through fixed and lagging price contracts, but it has a 6-month lag on iron ore pricing, internal coke ovens, long-term below market contracts for coke and coal, a JV for steel scrap, and an on-site cogeneration facility to fulfill half of power needs.

3. Geographic Positioning - due to access to the Great Lakes on a large port, Algoma has access to low cost freight shipping along with railroads for cheap iron ore access and an advantage when selling to customers in the region.

4. Electric Arc Furnace transition - the company is in the process of turning off its dirty BOF and installing a green EAF to not only become one of the greenest steel producer, but also reduce maintenance, increase capacity, and avoid carbon taxes, giving them a cost advantage.

Notable ESG considerations for sake of future government financing, possible acquisition by energy transition/ESG fund, and for sake of sustainability:

• Legacy environment Liabilities - As discussed the company has gone through many phases of ownership and in these last 118 years, the area has been contaminated. During the 2018 restructuring, the company with the Ontario government worked out a 20-year annual payment of $3.8M CAD and give a $10M CAD letter of credit to release the company from soil/land contamination. Also, at its predecessor’s iron ore mines, the company has to pay a 20-year annual payment of $500k CAD and give a $3.5M CAD letter of credit.

• Carbon Emission Reduction - The transition to EAF from BOF will reduce carbon emissions by 3 million tonnes or by 70%, reduce sulfur oxide emissions by 82% or 4,060 tonnes, nitric oxide emissions by 1,604 tonnes or 52%. This reduction is equal to 100% of Ontario’s 2030 target for industrial emitters and 11% of the federal government’s target. The electricity for the EAF will come from the 92% clean energy (green) Ontario Grid once fully set up.

• Carbon Tax - for 2023, emissions are set at $65/tonne over industry standard, while for 2030, it will be $170/tonne. These carbon taxes will be gone in two years with the EAF transition, for reference they were $5M -$6M CAD in FY2023, this is not even considered in the ROIC calculation for the EAF.

• Labour & Governance - of the company’s almost 3,000 workers, they are represented by two unions who just signed a 5-year labour agreement this past summer. As of current the pension is solvent and well-managed with negotiations leading to another contribution. With Algoma distributing over $150M CAD to employees in FY2022 with a profit-sharing program, they are possibly the best paid workers in the Canadian Steel Industry. Though this is a bit of negative, it also removes the risk of strike considerably.

• Along with this, the company plans for the desulfurization of its coke ovens by January 1, 2026, costing roughly $60M CAD.

Ownership:

The shareholder base of Algoma Steel, in my opinion, really sheds light on the opportunity at hand due to the significant amount of actively managed capital.

Here is the list of actively managed capital:

The most notable among these are Bain Capital, GoldenTree, and Contrarian Capital which are all funds that were involved in Algoma’s restructuring during Bankruptcy protection. Though Bain & Contrarian have been exiting slowly, it is not something to worry about considering they have significantly lower cost basis and were expected to eventually leave.

What is good to notice is that these other active funds have been not only driving a significant amount of volume (3-month D.A.V is 1.35M), but have been building their position significantly and when looking at their holdings, are very value-oriented.

Management:

The management team is pretty solid, I don’t see the point in spending too much time talking about them.

First of all the Board of Directors does hold some founders who notably retained their equity interest post-SPAC, such as Brian Pratt who just resigned 2 weeks ago and Eric Rosenfield. Along with this, past CEO Michael McQuade, who also continues to hold equity interest, is on the Board.

For the Management team, the new CEO Michael Garcia is a good amount of experience having been the CEO of South African steel operation and president of pulp production operation, and he has been pretty capable so far. The reason for McQuade leaving was likely he was just tired as he was 69 years old and had helped to lead algoma through its restructuring and SPAC, along with expressing some sentiment that Algoma was to aggressive in pushing for EAF. Rajat Marwah is the CFO and he has been with the company since ‘08 which is always nice to see from CFOs. This is the only other officer I’ll mention, but Mark Nogalo who is the SVP leading the EAF transformation has worked at the company for 35 years and so is definitely a good pick to lead the project.

In regards to insider holdings, as said before some founders and current boards members have significant positions (Brian Pratt, Eric Rosenfield, Michael McQuade) along with all SVPs and C-suite executives besides CEO Michael Garcia having considerate insider ownership, which is a small point of concern, but this is likely due to time in position only being 6 months.

Capital Returns:

Any worries about misalignment of management with investors are gone when looking at the value returned through shareholders seen through its Algoma’s regular dividend of 0.05 per quarter, its Normal Course Issuer Bid which has been active for the last two years at 5% of outstanding shares each year it is reset, and its Substantial Issuer Bid which occurred last year and bought 28% of shares outstanding, making up for issuance of common stock for earnout-rights post-SPAC.

In its current state, Management is striving for modest capital returns while ensuring the funding of its two projects (plate & EAF) in order to keep a conservative balance sheet.

Peer Analysis:

For comparison to Algoma, we are going to look at Steel Dynamics (STLD), Nucor (NUE), Stelco (STLC), Cleveland-Cliffs (CLF), U.S Steel (X/USS), ArcelorMittal (MT), and Commercial Metals Company (CMC).

The first type of companies we will look at are the vertically integrated mill operators: CLF, USS, & MT. These companies not only have large BOF & EAF integrated mills, but also mine, use, and sell their iron ore along with other materials like coal which MT also mines. Because these companies operate with BOFs and are in more commoditized industries like iron ore, they tend to have varying margins with USS at a 20-year average EBITDA margin of 7.7% while CLF is in the low 20s due to restructuring and mergers warping financials, and MT at 14% because of its scale and global operations. These companies trade at a wide variety of multiples with CLF at 11x earnings and 3.5x EV/EBITDA forward-looking (NTM) and USS at 5.5 EV.EBITDA and 8x earnings.

The next type are the pure-play mini-mill EAF operators (NUE, STLD, CMC) who may do some steel scrap sourcing but are focused on mini-mill steel production, encompassing many steel types like rebar, merchant, sheet, plate, etc. They have pristine records of growth and NUE & STLD have never once had negative EBITDA in the last 20 years, on an annual basis. This long-term profitability along with less volatility in earnings due to more variable costs makes it so they have mid-high teen 20-year average margins with NUE at 14.0% and STLD at 15.8%. This makes it so they command a premium multiple regularly traded in the EV/EBITDA multiple range of 4x - 8x, with both commanding a NTM earnings multiple of 10x for NUE and 8x for STLD.

The last and, in my opinion, most important comparison class is the independent operator, in this case being the Ontario-based Stelco. Stelco is recognized to be the most efficient at scale independent blast furnace operator in NA and after the recent run up, also command a pretty high NTM earnings multiple of 7x and an EV/EBITDA multiple of just over 4x.

The fact that Stelco Ships on average only 300kt more of finished steel than Algoma, yet it doesn’t sell steel plate, and has equally high utilization rates of above 90%, similar to that of STLD and NUE, yet only Stelco is given a premium multiple comparable to that of the two EAF players is crazy.

It is clear that Algoma at 2x - 2.5x EV/EBITDA multiple and just 5x estimated earnings is deeply undervalued, without evening considering its EAF transition and plate mill modernization, and its previously discussed moat.

Financial Analysis & Estimates:

The company released Q1 2023 guidance of 555kt - 565kt and Adjusted EBITDA of $25M - $30M CAD. My previous Basic Oxygen Furnace rendition had predicted $35M in Adjusted EBITDA and 550k in shipments, among other things. This small difference in commodity prices I attributed to fixed coal pricing and by-products pricing. What has to be remembered is that it is impossible to have a perfect model especially with over 10 moving parts with their separate pricing components, so this closeness is more than good enough.

Over the past 3 months, prices have risen fast with NUE hiking prices by $400/nt to $1,150/nt for HRC, CLF also setting a similar minimum at $1100 - $1200/nt USD for HRC, and importantly based on geography, Dofasco (MT subsidiary) rose HRC price min. To $1560/nt USD for HRC, levels not seen since Q2 2022, when Algoma produced $400M CAD in EBITDA and $200M CAD in FCF excluding CNWC (change in net working capital) but including EAF investments.

The average Net Sales Realized (NSR) per ton of sheet should be around $1500 CAD/nt for Q2 2023, meaning that with a $300/nt gap for plate, EBITDA should be at a minimum $250M CAD (more likely to be $300M) and at a max $350M CAD. For the midpoint scenario, this produces $140M in FCF, excluding CNWC and including EAF Capex.

Valuation:

What needs to be noted for the EAF modeling is that yes EBITDA is expanding by $150M CAD incrementally, but fixed costs will also be significantly reduced and scrap will become the largest input by cost. Due to the high correlation of steel scrap prices with steel pricing, this has resulted in EAF players like NUE and STLD staying profitable with an average EBITDA margin of 12% minimum. Algoma should be more efficient in theory because of their, on average, better geography, newer equipment, and plate mill. To be conservative in our financial Analysis, we are going to use the 12% EBITDA margin for forecasting past 2024.

Over the last 15-20 years, average HRC price has been $715 USD/ton, average Plate price has been $950 USD/ton, and average CRC price has been $830 USD/ton. Instead assuming an HRC price of $600, CRC of $700, and Plate of $800 to be conservative, along with our conservative 12% EBITDA margin, we get the following for 2025 and 2028 at current exchange rates:

Though the specifics are not very important, it is more than worth mentioning that the balance sheet is pristine with the only debt being low-interest government debt of only $90M USD with cash of $180M USD. This is both a problem and a soon benefit, but inventory buildup of around $300M because of the price environment and seasonality, totaling $912.2M CAD, though Tangible Equity is still significantly above market cap with it being $1.72B CAD.

3-year Worst Case: Even with this very conservative EBITDA figure, if we take the present value of it at 10% discount rate, we get $358M USD in EBITDA, and if we assume a 4x EV/EBITDA multiple, then subtract the calculated value difference of $234.7M CAD or $173.7M USD, we get a worst case market cap of $1.26B USD in 2-3 years which at current shares oustanding is a per share price 12.15 versus the current price of 8.03, or a CAGR of 15% in a 3-year timeframe.

3-year Conservative/Realistic Case: Because this is the worst case, for my realistic yet still conservative price target, I am going to keep my conservative steel pricing the same along with my margins, but adjust the multiple to a reasonable 6x EV/EBITDA and assume that the cash generated in the next two years is $235M CAD or enough to cover the expenditures for the E.V difference. Yet I remind you that my estimates put FCF at $5M - 10M CAD in Q1 2023 and at least $140M CAD in Q2 2023, so this is still pretty conservative as it still assumes a recession and bad steel environment afterwards. This gives us a valuation of $2.146B USD or 20.72 at current shares outstanding, equivalent to a 3-year CAGR of 37%.

Warrants:

One thing to note for price targets is the share structure. Because of their SPAC process, there are 24.179M in warrants granting an option to buy shares at $11.50 strike price with a November 18th, 2026 expiration. These are to be exercised by cash/cash-less option at Algoma’s discretion. The current price is 1.69, and yes these are possibly even more attractive, but the problem is that in the event of an acquisiton below 11.50, they are worthless, and I view this as a serious possibility by a company such as USS, CLF, or MT. This represents a warrant liability of $40.86M USD as of now. Though it would lead to a roughly 25% dilution upon exercise, it can be mitigated by buying warrants and shares on a 1:4 ratio which only increases the price theoretically by about 5% which is insignificant compared to the this opportunity, but should be known in terms of exacts.

Acquisition Possibility:

As just Discussed, I view it as a serious possibility that Algoma gets acquired by a company like U.S Steel, Cleveland-Cliffs, and ArcelorMittal which have integrated Steel mill operations with both EAF and BOF. The Price tag of say a 40% Premium or a $1.1B valuation is very attractive as seen through current project pricing. Some examples: Nucor West Virginia EAF sheet mill with 3000kt capacity for $2.7B, Steel Dynamics Sinton Texas EAF flat-roll mill with 3000kt capacity, U.S steel Osceola Arkansas EAF mill with 3000kt capacity for $3B, and Nucor EAF Rebar micro-mill in South Atlantic with 430kt capacity for $350M.

Investment Summary and Thesis:

Algoma Steel is an Ontario-Based independent steel operator undergoing a transition from Basic Oxyegn Furnace to Electric Arc Furnace improving its operational efficiency while increase capacity and decreasing emissions, making it the greenest steel producer in North America, the poster child of the Canada’s green movement.

To recap the most important details (thesis):

• Greenest Steel Producer in North America with 70% reduction in emissions, with access to government financing, legacy environmental liabilities erased, and lowered carbon taxes.

• Access to Deep Water Port in Sault Ste. Marie making Algoma the closest steel mill to iron ore suppliers, close proximity to scrap steel centers, competitively priced contracts for input materials, and freight cost advantage.

• Competitive Steel pricing because of 60% - 65% of steel is contracted through a fixed price mechanism and lagging price mechanism, with the rest being spot, allowing the company to utilize the lag on its material pricing to maintain profitability in down times.

• Diverse product mix with a variety of finishings that can be added along with ownership of the only plate mill in Canada undergoing a modernization to enhance quality and double capacity.

Besides its operational efficiency and strong moat, Algoma is severely undervalued on almost every metric. The Company has been able to produce strong cash flow with $1.1B CAD in FCF in FY2022 with a balance sheet with little leverage besides government debt with Tangible Book Value $1.7B CAD composed largely of Inventory to be sold in the coming quarters and cash. The company in this tumultuous, yet strong, steel environment, should be able to produce over $300M in EBITDA over the next-twelve months with a high degree of cash-flow conversion as a significant amount of its EAF transition will be paid for by government grant.

By 2025 and beyond, they will be able to consistently produce $200M - $400M in FCF with low maintenance capital expenditures and variable costs allowing for reliable profitability.

Assuming a wise steel company doesn’t purchase Algoma Steel, I would expect at the minimum that over the next 3 years, the company should achieved my 3-year price target of 20.72 compared to current price of 8.04, equating to a 37% CAGR.

Investment Risks

• Plate Modernization phase two meets same bottlenecks as phase 1 and hurts profitability for 1-2 quarters.

• EAF transformation delay or budget grows more than contingency.

• Commodity markets become more volatile and pricing for material inputs rise significantly and steel prices go down.

• The company is not able to release inventory at favorable price in relation to cost and takes a significant write-down in the coming quarters.

• SIF loan does not turn into grant due to emissions in someway missing targets.

Catalysts

• Financial Outperformance seen in the next few quarters

• Completion of plate mill modernization adding capacity and higher pricing from quality.

• Completion of EAF Transformation and its affect on more reliable profit margins